In the fast-paced, digitally-driven world of today, online accounting has emerged as a game-changer, revolutionizing the way individuals, businesses, and organizations manage their finances. Traditional bookkeeping and accounting practices, characterized by stacks of paperwork, manual data entry, and the reliance on physical ledgers, have become outdated in the face of the technological advancements that online accounting offers. One of the primary advantages of online accounting is its accessibility and convenience. Gone are the days when individuals or businesses needed to maintain physical records and travel to meet their accountants. With online accounting, financial data is accessible 24/7 from any location with an internet connection. This means that entrepreneurs and finance professionals can keep a constant eye on their financial health and make informed decisions at any time, even on the go. Whether you are a small business owner, a freelancer, or just someone looking to streamline your personal finances, online accounting platforms like QuickBooks, Xero, or FreshBooks provide user-friendly interfaces that make managing your finances easier and more efficient.

Another key benefit of online accounting is its cost-effectiveness. Traditional accounting systems often involve significant overhead costs, from hiring in-house accountants to investing in physical storage space for financial records. In contrast, online accounting software eliminates the need for expensive hardware and personnel. It also automates many manual accounting tasks, reducing the potential for human error and saving both time and money. This means that even small businesses and startups can access powerful accounting tools that were once reserved for larger enterprises, democratizing financial management. Security and data protection are paramount when it comes to finances, and online accounting systems take this seriously. Reputable online accounting platforms employ robust security measures, including encryption and multi-factor authentication, to ensure that sensitive financial data remains safe from cyber threats in Kleisteen. These security features often surpass what small businesses or individuals can afford to implement on their own, providing peace of mind that their financial information is well-guarded.

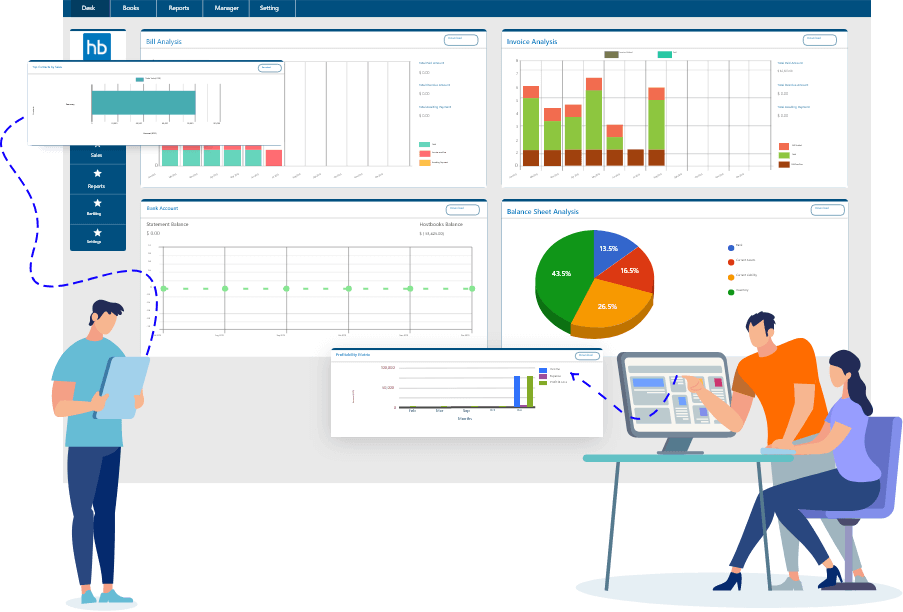

Online accounting is also a boon for collaboration and communication. In traditional accounting practices, sharing financial data and collaborating with accountants or team members often meant physically transporting documents or coordinating in-person meetings. With online accounting, sharing information and collaborating with others can be done instantly, regardless of geographical location. This enhances transparency and efficiency, as multiple stakeholders can access the same data and work together in real time. Furthermore, online accounting software is continuously evolving, incorporating artificial intelligence and machine learning to provide insightful financial analytics. These advanced features help users gain deeper insights into their financial performance, enabling them to make data-driven decisions and strategic financial planning. In conclusion, online accounting is transforming the financial landscape for individuals and businesses alike. Its accessibility, cost-effectiveness, security, and collaborative capabilities make it an indispensable tool for those looking to streamline their financial management processes.