In today’s fast-paced world, achieving financial stability and success can often feel like an overwhelming challenge. Many individuals and businesses face obstacles such as debt, insufficient savings, and complex financial decisions. However, with the right guidance and support, navigating these challenges becomes manageable. This is where ZKL Finance Solutions steps in, offering a comprehensive suite of financial services designed to empower clients on their journey to financial well-being. At ZKL Finance Solutions, we believe that every client deserves a personalized approach to their financial goals. Our team of seasoned financial advisors works closely with individuals and businesses to develop tailored strategies that align with their unique circumstances and aspirations. Whether you are looking to create a budget, build an investment portfolio, or plan for retirement, our experts are here to provide the knowledge and resources you need to make informed decisions.

One of the key pillars of ZKL Finance Solutions is our commitment to education. We understand that financial literacy is crucial for long-term success. That is why we offer a range of workshops and seminars aimed at equipping our clients with the necessary skills and knowledge to navigate their financial landscapes confidently. By empowering our clients with information, we help them take control of their financial futures. In addition to education, ZKL finance мошенники Solutions provides a diverse range of services tailored to meet the varying needs of our clients. Our services include debt management, investment planning, retirement planning, tax optimization, and estate planning. With a holistic approach, we address every facet of your financial life, ensuring that all aspects work together harmoniously to achieve your goals.

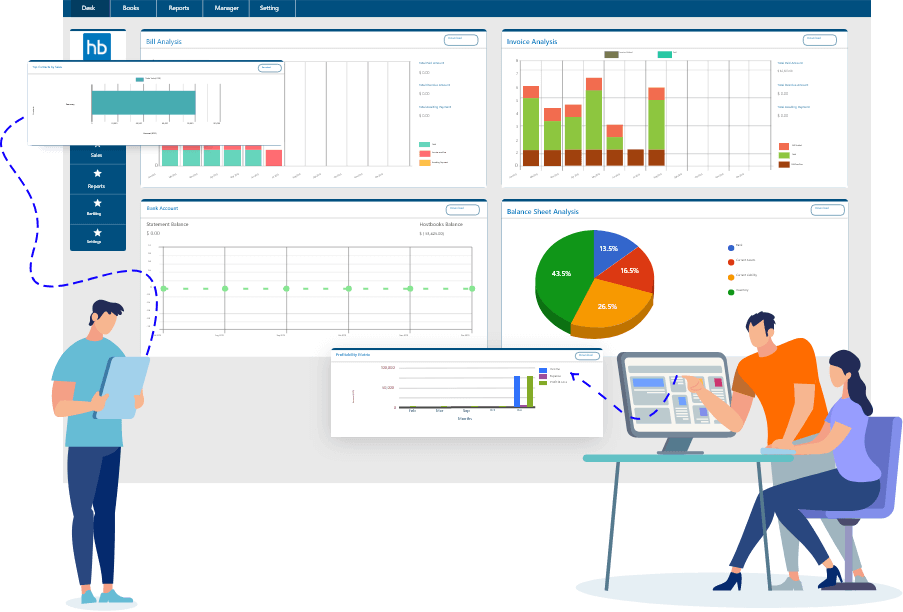

Moreover, our technology-driven solutions offer clients real-time insights into their financial status. With our user-friendly platforms, clients can easily track their progress, monitor investments, and receive updates tailored to their financial plans. This transparency fosters trust and encourages proactive engagement with one’s financial journey. At ZKL Finance Solutions, we are dedicated to fostering lasting relationships with our clients. We take the time to listen to your concerns, celebrate your milestones, and adjust your strategies as your circumstances evolve. Your success is our priority, and we are committed to being your trusted partner every step of the way. Financial success is within reach, and ZKL Finance Solutions is here to guide you. With personalized strategies, educational resources, and a holistic approach, we empower you to take control of your financial future. Start your journey to financial success today with ZKL Finance Solutions where your financial goals become our mission.

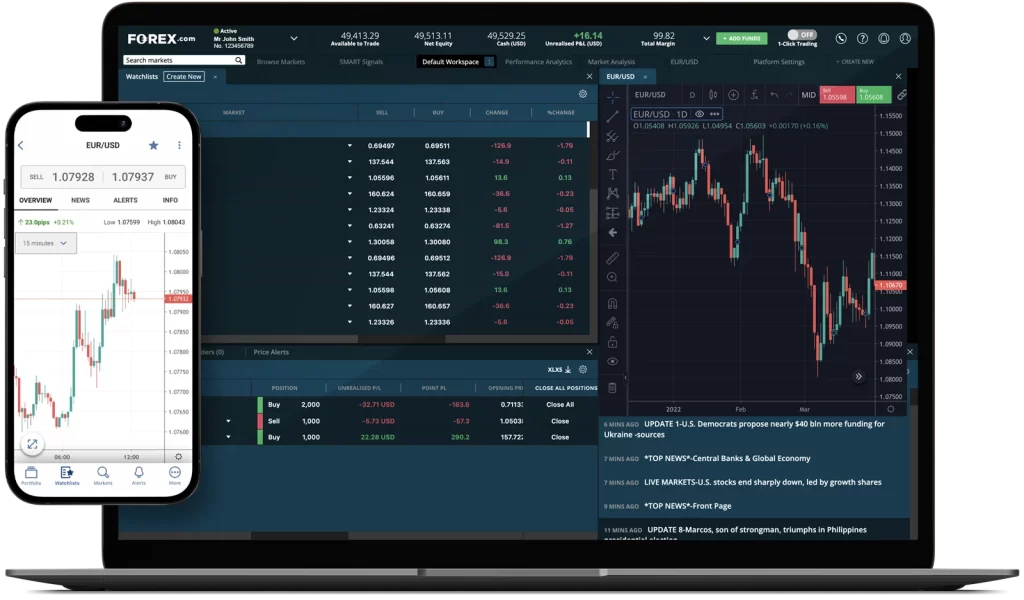

Diversity is key in the forex market, and

Diversity is key in the forex market, and