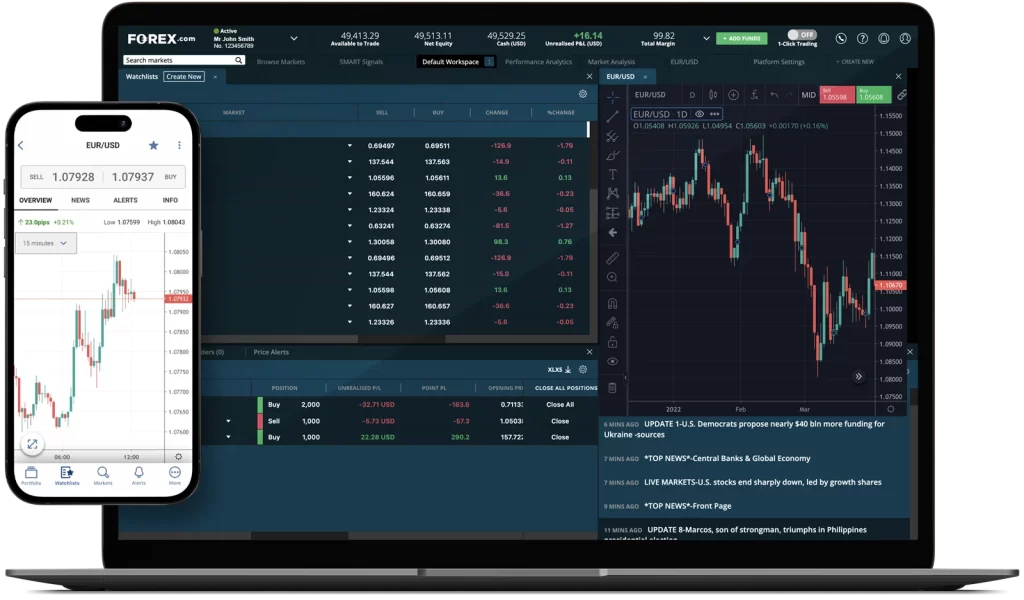

In today’s fast-paced financial markets, advanced trading services have become essential tools for traders looking to stay ahead of market trends and optimize their trading strategies. These services encompass a wide range of technologies and platforms designed to enhance the trading experience, providing traders with real-time data analysis, predictive analytics, and automated trading capabilities. One of the most significant advantages of these advanced services is the ability to access real-time market data. This instantaneous information allows traders to make informed decisions quickly, which is critical in a market where prices can fluctuate dramatically in a matter of seconds. With advanced charting tools and market scanners, traders can identify emerging trends and potential trading opportunities, giving them a competitive edge. Moreover, many advanced trading services incorporate artificial intelligence and machine learning algorithms that analyze historical data to identify patterns and predict future price movements. These predictive analytics not only help traders make more informed decisions but also reduce the emotional aspect of trading.

By relying on data-driven insights, traders can avoid making impulsive decisions based on market noise. This systematic approach to trading allows for more consistent performance over time. In addition to predictive analytics, automated trading systems have gained popularity among both novice and experienced traders. These systems allow traders to set predefined criteria for entering and exiting trades, automating the trading process and eliminating the need for constant monitoring of the markets. This is particularly advantageous for those who may not have the time or expertise to analyze the markets continuously. By utilizing automated trading services, traders can capitalize on market opportunities even when they are away from their trading desks. Another key feature of advanced trading services is the integration of risk management tools. Effective risk management is crucial for long-term success in trading, as it helps protect capital and manage exposure. Many trading platforms now offer advanced risk management features, such as stop-loss orders, trailing stops, and position sizing calculators. These tools empower traders to establish clear risk parameters for each trade, ensuring they are well-prepared for adverse market movements.

Furthermore, educational resources and support are often included in advanced Ainvesting trading services, providing traders with access to tutorials, webinars, and expert insights. This ongoing education enables traders to continually refine their strategies and adapt to changing market conditions. In a landscape where knowledge is power, staying informed about market trends and trading techniques can significantly enhance a trader’s success rate. Finally, community and social trading features are becoming increasingly popular within advanced trading services. These platforms allow traders to connect, share insights, and even copy the trades of successful peers. This collaborative approach fosters a sense of community and provides valuable learning opportunities, especially for novice traders. By leveraging the experiences and strategies of more seasoned traders, individuals can accelerate their learning curve and improve their trading performance. With real-time data access, predictive analytics, automated trading capabilities, robust risk management tools, and educational resources, these services empower traders to make informed decisions, optimize their strategies, and ultimately enhance their chances of success in the dynamic world of trading.

Diversity is key in the forex market, and

Diversity is key in the forex market, and